Unraveling Tax Jargon: Making Sense of Tax-Exempt, Tax-Deferred, and Tax-Deductible — SimpMe

Tax planning is an important context whether you are planning for retirement, a specific goal (think wedding planning, or your child’s education) or simply planning to optimize your excess funds. It is common for people to continue saving or deferring taxes for many years only to face a huge tax bill when they start withdrawals. There is no escaping the tax man, it is just a matter of optimizing when you pay up. The goal is to grow your assets while MINIMIZING the tax bill.

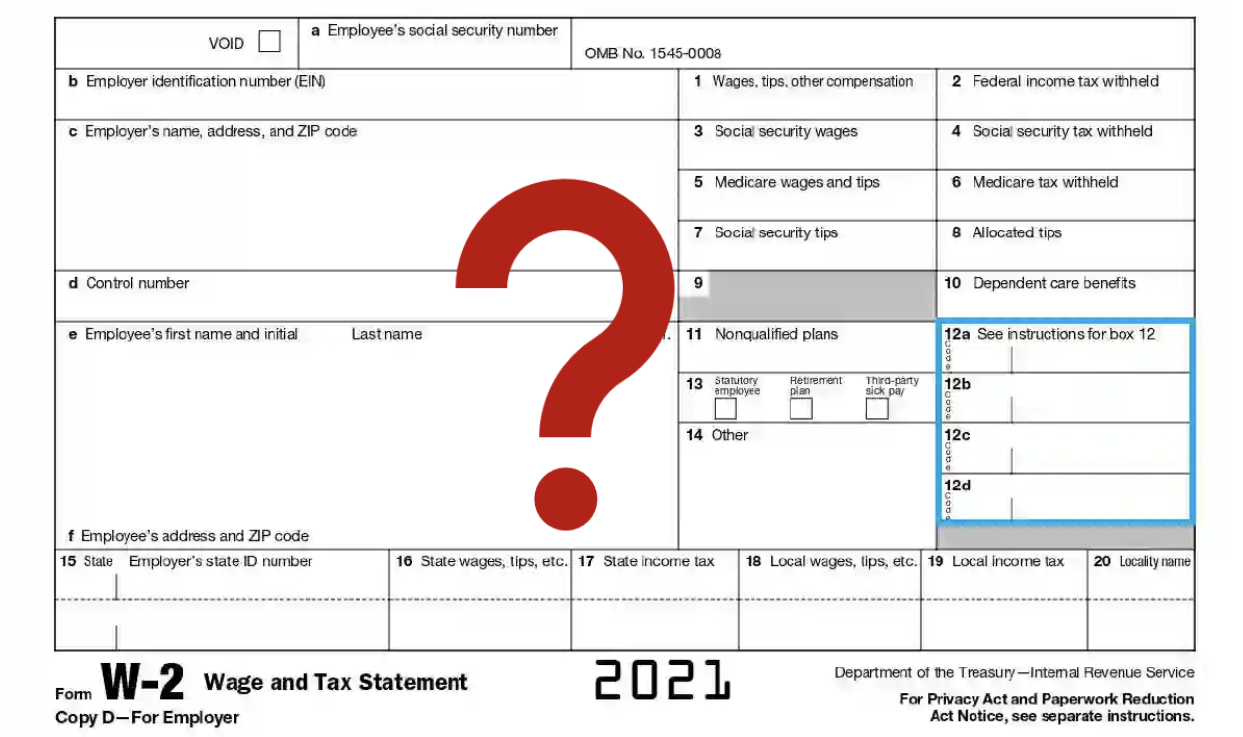

Decoding Your W-2 — SimpMe

Ah, the W-2 form—that annual document you get from your employer, which you hastily sent off to your accountant or plugged into TurboTax without a second glance. But have you ever paused and wondered, 'What do all these numbers mean?' and 'How did they even come up with these figures?' While tax calculations can vary wildly depending on everyone's specific income and situation, it's still a mystery shrouded in payroll paperwork for most of us. Let’s unravel this mystery and dive into each of the various boxes on the form to decode your W-2.